Why does inflation (in the economy) exist, and who controls it?

An Overview of Inflation: What Causes It and Who Has Control?

Inflation is an economic phenomenon that causes prices to rise over time. Many people don't understand why it happens, or who has control over it. To answer those questions, we need to look at the factors that cause inflation and the entities that have the power to influence it.

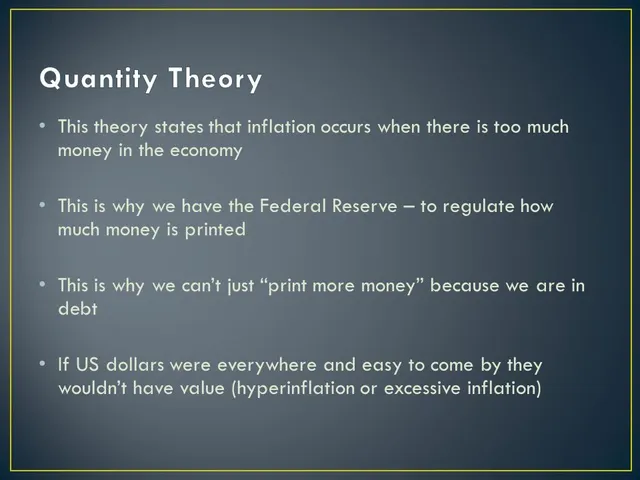

What Causes Inflation? The most common cause of inflation is an increase in the money supply. When the government prints more money, the value of each dollar goes down. This leads to higher prices for goods and services. In addition, a growing economy can cause inflation as businesses compete for limited resources, which drives up prices. Finally, an increase in taxes or tariffs can also lead to inflation.

Who Has Control Over Inflation? In most countries, the central bank is responsible for controlling inflation. They do this by setting interest rates and controlling the money supply. The government also plays a role in influencing inflation through taxation and spending policies. Finally, businesses have some control over inflation by setting prices and controlling the availability of goods and services.

Inflation can have both positive and negative effects on an economy. In the short-term, it can create jobs and stimulate growth, but in the long-term, it can lead to a decrease in purchasing power. Understanding the causes of inflation and who has control over it is key to managing it effectively and ensuring a healthy economy for everyone.

Examining the Impact of Inflation on the Economy and Who Can Influence It?

Inflation is a persistent rise in the general price level of goods, services, and wages in an economy. It is a key indicator of economic health and a major factor in the cost of living and business operations. Inflation has a significant impact on the economy and is largely determined by the policies of the central bank, government, and other economic actors.

When the cost of goods and services increases, the cost of living also increases, leading to a decrease in purchasing power. This can reduce consumer demand, leading to a slowdown in economic growth. The rate of inflation also affects the value of money, making it difficult to save and invest. It can also lead to greater uncertainty in the markets, making it difficult for businesses to plan and budget their operations.

Inflation is largely determined by the actions of the central bank and government. The central bank can influence inflation by setting interest rates and controlling the money supply. The government can also influence inflation through fiscal policy, such as tax cuts and spending increases. In addition, other economic actors, such as businesses, consumers, and investors, can also have a direct impact on inflation.

Businesses can influence inflation by increasing or decreasing production and prices. Consumers can also have an impact on inflation by changing the demand for goods and services. Investors can influence inflation by investing in assets that are expected to increase in value over time. All of these economic actors can have a direct impact on the rate of inflation.

Inflation can have both positive and negative effects on the economy. It can lead to higher wages and increased consumer spending, which can boost economic growth. However, it can also lead to higher prices and reduced purchasing power, which can lead to a slowdown in economic growth.

Inflation is an important factor in the economy and is largely determined by the policies of the central bank, government, and other economic actors. It is important to understand the impact of inflation and how it can be influenced in order to ensure a healthy and prosperous economy.

Exploring the Causes of Inflation and Who Sets the Rate?

Inflation is an economic phenomenon that is often misunderstood. It is a measure of the average rate at which prices for goods and services increase over time, and it is an important concept to understand when it comes to managing a country's economy. Inflation is caused by a variety of factors, and it is primarily controlled by a country's central bank.

The primary cause of inflation is the growth in the money supply. When the money supply increases, it leads to an increase in prices. This is because there is more money chasing the same amount of goods, which increases the demand for these goods. This in turn leads to higher prices. When the money supply is reduced, the opposite happens – prices decrease.

Inflation is also caused by higher demand from consumers. When demand increases, prices tend to increase as well. This is because there is an increased demand for goods, but the supply remains the same. This can lead to higher prices, which in turn leads to inflation.

Inflation is also caused by an imbalance in the supply and demand of goods and services. When supply is low and demand is high, prices tend to increase. This is because the demand is outstripping the supply, which leads to higher prices.

The rate of inflation is primarily controlled by a country's central bank. The central bank sets a target rate of inflation, and then adjusts the money supply and interest rates to reach this target. By doing this, the central bank is able to control the rate at which prices increase.

Inflation is an important concept to understand when it comes to managing a country's economy. It is caused by several different factors, and it is primarily controlled by a country's central bank. By setting the target rate of inflation, the central bank is able to control the rate at which prices increase. This helps to maintain economic stability and promote economic growth.

Who Has the Power to Control Inflation and What Are the Consequences?

Inflation is a natural phenomenon that occurs when the prices of goods and services rise. It has far-reaching consequences, such as higher costs of living, decreased purchasing power, and even economic downturns. So, who has the power to control inflation, and what are the consequences of this power?

Inflation is primarily controlled by central banks, such as the Federal Reserve in the United States. Central banks are responsible for setting monetary policies, such as interest rates, which affect the rate of inflation. When the interest rates are increased, it becomes more expensive for businesses to borrow money, which in turn increases the cost of goods and services. Similarly, when the interest rates are lowered, it becomes less expensive for businesses to borrow money, resulting in lower prices and decreased inflation.

The consequences of this power are far-reaching. Inflation can lead to higher prices, decreased purchasing power, and an increased cost of living. It can also lead to economic downturns, as high inflation can discourage investment, reduce consumer spending, and cause businesses to cut costs. Inflation can also cause unemployment, as businesses may have to lay off workers in order to remain profitable.

Although central banks have the power to control inflation, there are other factors that contribute to inflation, such as increases in the supply of money, increases in the cost of production, and increases in demand. These factors are often outside of the control of central banks, so it is important for governments to consider other methods of controlling inflation, such as fiscal policies, which involve taxation and government spending.

In conclusion, central banks have the power to control inflation, but the consequences of this power can be far-reaching. It is important for governments to consider all of the factors that contribute to inflation, and to use a variety of measures to maintain an appropriate level of inflation. This is important for economic growth and stability, and for ensuring that people have the purchasing power they need.