If the Fed stops raising interest rates, what will happen?

Exploring the Implications of a Federal Reserve Interest Rate Freeze

In the wake of the Fed's announcement that it would not be raising interest rates any further, many analysts have been left wondering what the implications of such a move will be. There are several factors to consider when exploring this topic, including the impact on the economy, the stock market, and consumers.

Economic Impact

The economic impact of a Federal Reserve interest rate freeze is difficult to predict. In general, a freeze in the rate could lead to an increase in economic activity as businesses would have access to cheaper borrowing costs. This could lead to an increase in employment and wages as businesses would be more likely to invest and expand. On the other hand, a rate freeze could lead to a decrease in economic activity if the cost of borrowing becomes too low, leading to a decrease in demand for goods and services.

Stock Market Impact

The stock market could also be affected by a Federal Reserve interest rate freeze. In the short term, a rate freeze could lead to a rally in the stock market as investors would be more likely to invest in stocks due to lower borrowing costs. On the other hand, in the long term, a rate freeze could lead to a decrease in stock prices as investors may be less likely to invest in stocks if the cost of borrowing is too low.

Consumer Impact

The effects of a Federal Reserve interest rate freeze would also be felt by consumers. In the short term, consumers would benefit from lower borrowing costs and could take advantage of lower interest rates on mortgages, car loans, and credit cards. On the other hand, in the long term, consumers could be negatively impacted if the cost of borrowing is too low, leading to a decrease in demand for goods and services.

Conclusion

Overall, the implications of a Federal Reserve interest rate freeze are difficult to predict. In general, it could lead to an increase in economic activity and a rally in the stock market in the short term. However, in the long term, it could lead to a decrease in economic activity and a decrease in stock prices if the cost of borrowing is too low. Consumers could benefit in the short term, but could be negatively impacted in the long term if the cost of borrowing is too low.

Understanding the Impact of a Federal Reserve Interest Rate Pause

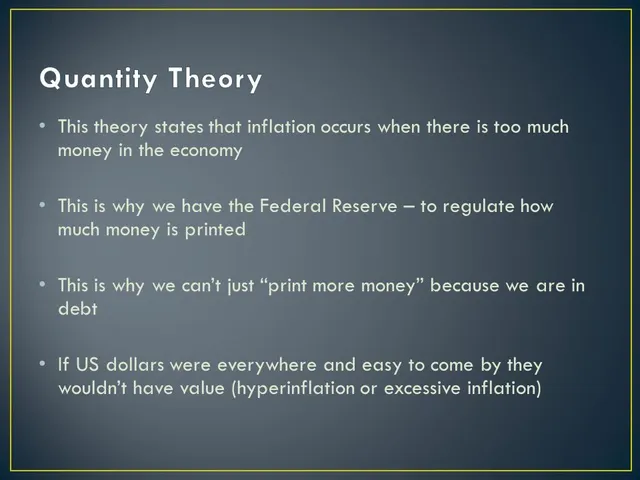

When it comes to the economy, the Federal Reserve is one of the most powerful institutions in the United States. Its decisions and policies can have a profound effect on the economy and the lives of ordinary citizens. One area where the Federal Reserve has an enormous impact is on interest rates. When the Fed raises or lowers interest rates, it can have a significant impact on the economy.

So what would happen if the Fed were to pause in its policy of raising interest rates? The answer to this question is not simple and depends on a variety of factors, including the state of the economy, the rate of inflation, and the goals of the Federal Reserve. In general, however, a pause in raising interest rates could have both positive and negative impacts.

Positive Impacts

One of the possible positive impacts of a pause in raising interest rates is that it could provide some economic stimulus. Lower interest rates can make borrowing cheaper for businesses and individuals, which can lead to increased investment and more spending. This increased spending can help boost economic growth, which can lead to more jobs and higher wages.

In addition, a pause in raising interest rates could help to reduce the risk of a recession. When the Fed raises interest rates too quickly, it can lead to a sharp decline in economic activity, which can lead to a recession. By pausing in its policy of raising interest rates, the Fed can help to avoid this scenario.

Negative Impacts

On the other hand, a pause in raising interest rates can also have some negative impacts. For example, it can lead to higher inflation, as lower interest rates can lead to an increase in money supply. This can lead to higher prices for goods and services, which can in turn lead to lower real wages and a decrease in purchasing power.

In addition, a pause in raising interest rates can also lead to a decrease in savings. When interest rates are low, people are less likely to save, as they can get a better return on their investments elsewhere. This can lead to a decrease in consumer spending, which in turn can lead to a decrease in economic growth.

Conclusion

Overall, a pause in raising interest rates can have both positive and negative impacts on the economy. It can provide some economic stimulus, but it can also lead to higher inflation and a decrease in savings. As such, it is important to consider the possible effects of a pause in raising interest rates before implementing such a policy.