Why does inflation (in the economy) exist, and who controls it?

Inflation is the result of a complex interplay between the amount of money in circulation, the demand for goods and services, and the availability of goods and services. It is generally controlled by central banks and governments, who use a variety of tools, such as interest rate changes, to influence the economy. Inflation is a normal and expected part of a healthy economy; when it is too high, central banks and governments will take steps to reduce it. When it is too low, they will take steps to increase it. Inflation can have both positive and negative effects on the economy, so it is important for central banks and governments to keep a close eye on it.

Do the poor have a say in an economy?

The poor are often overlooked in conversations about economics, but they are an integral part of the economy. The poor have a say in the economy, both through their participation in labor markets, and their ability to influence public opinion and policy. Through their work, the poor have the power to shape the economy and create economic opportunities for themselves. They also have the ability to shape public opinion, and challenge policies that work against their interests. The poor have a voice and a role to play in the economy, and should be given the opportunity to be heard.

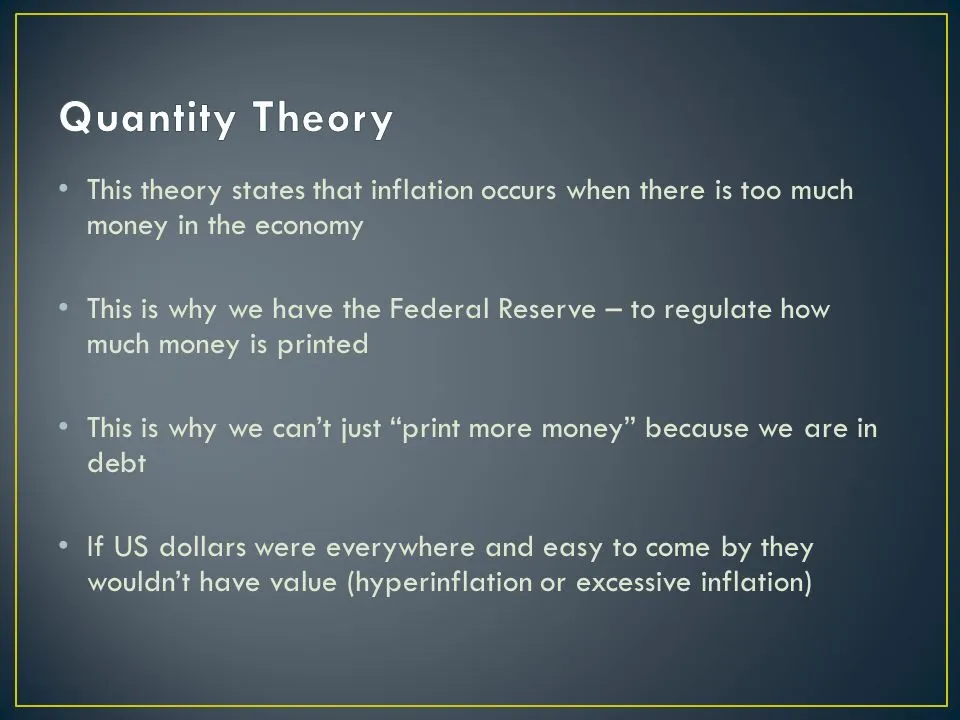

What happens when there is too little money in the economy?

When there is too little money in the economy, it can create a ripple effect of financial hardship. Businesses may struggle to stay afloat, as they are unable to invest in growth and development. Consumers may find it difficult to make ends meet, and may have to cut back on spending. Unemployment may rise, as businesses are unable to afford to hire employees. This can create a financial spiral, as fewer people have money to spend, leading to more businesses struggling, more unemployment, and so on. Ultimately, the economy can suffer greatly if there is too little money circulating.